artificial insemination kit for humans

artificial insemination kit for humans

The Child Tax Credit, introduced as part of The American Rescue Plan, is designed to provide unprecedented financial relief to working families during challenging times. As parents navigate this landscape, understanding the specifics of the Child Tax Credit is vital. We consulted with tax expert Jamie Rodriguez from Tax Insights, who clarified many of the most common inquiries about this beneficial program.

Am I Eligible for the Child Tax Credit?

To qualify for the full payment, your modified adjusted gross income (MAGI) must be $75,000 or less if you file as a single individual, or $150,000 or less for joint filers. If your MAGI exceeds these limits, the IRS will adjust your payment in two phases. In the first phase, the credit decreases by $50 for every $1,000 earned over the qualifying threshold. However, your credit amount won’t drop below $2,000, even if you earn significantly over the threshold. For single earners making over $200,000, or married couples earning above $400,000, the reduction remains the same.

To receive monthly payments, you must meet additional eligibility requirements:

- Your child must be claimed as a dependent on your tax return

- Your child needs to be a U.S. citizen, national, or resident alien and 17 or younger

- Your child must reside with you for at least half of the year and possess a valid Social Security number

- You must provide at least half of their financial support

How Much Can I Expect to Receive?

The amount you receive depends on your income and the number of qualifying children you have. Use this calculator to estimate your potential payment. For children aged 5 and under, you can receive up to $300 each month, while children aged 6 to 17 are eligible for up to $250 per month.

Do I Need to Apply for This Credit?

In most cases, the IRS will utilize your most recent tax return (either 2019 or 2020) to determine eligibility. If you aren’t required to file a tax return, you can register for the monthly payments here.

Will I Have to Repay This Credit When Filing Next Year?

Since the Child Tax Credit functions as an advance, if your payments exceed the amount you qualify for based on your 2021 tax return, you may need to repay some or all of it. For instance, if you reported three qualifying children in 2020 but only one in 2021, you might need to repay the excess amount unless you adjust your payment status in the IRS portal.

However, safeguards are in place for certain taxpayers: If you lived in the U.S. for over half the year and your MAGI falls beneath these thresholds, you won’t owe any repayment:

- $60,000 for married filing jointly or qualifying widow/widower

- $50,000 for head of household

- $40,000 for single filers or married filing separately

How Will I Receive My Child Tax Credit Payment?

If the IRS has your banking information, payments will be disbursed via check or direct deposit. The IRS gathers banking info from your most recent tax return, the non-filer tool, or other federal agencies like the Social Security Administration.

Are These Payments Taxed Monthly?

No, you won’t have to worry about monthly taxes on these payments.

This information may seem overwhelming, but it’s crucial for understanding how the Child Tax Credit can significantly benefit American families. Thanks to the Biden Administration for prioritizing support during such critical times.

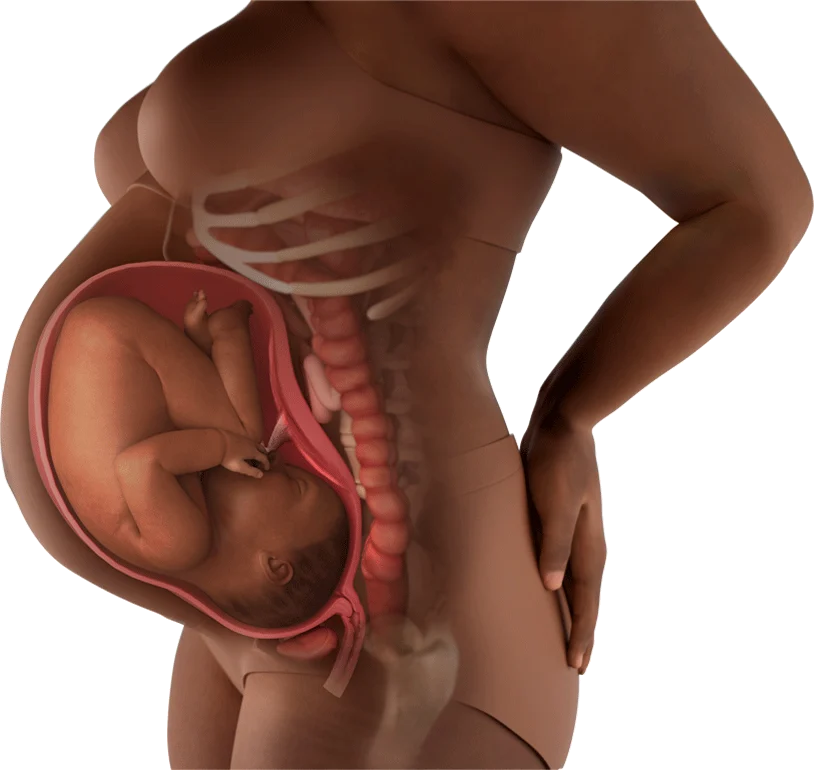

For more insights on pregnancy and home insemination, check out this excellent resource.

Leave a Reply